I signed up for a seminar for those interested in purchasing their first home. I've seen my coworkers attempt a number of different strategies: buying a condo, buying a home and investing out of state. Let's see how those strategies stack up. Note: Income and expenses were estimated with a single individual making $100k/yr. I also used a pretty healthy down payment as most of my coworkers are a) in their 30s and b) have had ~10 years of professional work experience that includes stock options. This does not reflect my income or savings, which may be higher or lower.

I used the mortgage estimator on CNN Money.

Assumptions:

- 30yr fixed

- 4.29% rate

- 1.9% property tax

- fixed insurance cost

- no PMI (result of >20% down payment)

- Down payment of $250k

- Fixed monthly expenses, including a $200/mth car note

Strategy Breakdown:

| Strategy | Cost | Down Payment | Ratio |

| SJ Condo | $400k | $250k | 63% |

| SJ House | $750k | $250k | 33% |

| SJ House2 | $750k | $400k | 53% |

| Austin House | $250k | $250k | 100% |

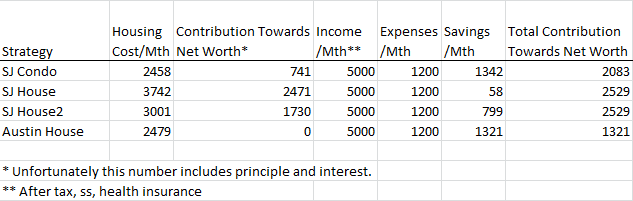

The results are in the image. The first thing to notice is that the housing cost has a $1284 spread but the contribution of that towards savings has a $2471 spread. At least one approach is better than the others, let's find out why.

First of all a bigger mortgage results in contributing more money towards savings with the number put towards principle. In the second example (SJ House) you would be extremely cash strapped. More interestingly is the comparison of buying a condo vs paying cash for an investment property out of state. The numbers are almost identical but you can see that buying a house out of state and renting in state contributes no additional money towards savings. You are still throwing money away on rent. More money, btw than what is wasted on mortgage interest.

Savings per month is calculated by subtracting monthly housing and expenses from monthly income (income-(expenses+housing)). Total contribution towards net worth is calculated by adding savings per month to the total contribution towards principle per month (savings+principle). You'll have to forgive the interest error (which is important) but the CNN calculator does not separate that out.

Buying a house is preferred if you can afford it. Coworkers using this approach win but they obviously have higher incomes or spouses. For a single person out of state investment is not as good as just buying a condo. It doesn't give you that financial freedom but it does contribute faster to your net worth. Out of state house could be a hassle and living in the right condo could be an upgrade to living in an apartment.

- Log in to post comments